Contact :

45 avenue Georges Mandel

75116 Paris

+33 (0)1 46 99 47 79

Patrimoine & Commerce has opted for the legal status of SCA (a partnership limited by shares), a mode of governance which is a real vector for development of the company.The SCA facilitates implementation of the development plan by lifting the constraints of ownership control (desire for extensive opening-up of the equity). The SCA allows an absolute separation of powers between the management bodies (the Managing Partners) and the control bodies (the Supervisory Board). Patrimoine & Commerce therefore wishes to ensure the independence of the control bodies of the real estate company. Thus, 11 of the 15 members of the Supervisory Board are independent within the meaning of the MiddleNext Corporate Governance Code.

Founder of Groupe Duval, Eric Duval is the initiator of the Patrimoine & Commerce project and its Managing Director. The property strategy is overseen by this recognised real estate professional. It is backed moreover by governance bodies which bring together commercial real estate players of affirmed independence. This favourable environment enables Patrimoine & Commerce to benefit from a wide network of business referrers from which many investment opportunities can be sourced.

Read the bio

"With a property portfolio of 76 assets and more than 528,000 sqm of retail space, Patrimoine et Commerce is today the property real estate company in low-cost retail parks in France. "

Pauline Duval is Managing Director of the Duval Group. She is a Member of the Executive Committee. After studying management at the University Panthéon Assas (Paris II), Pauline Duval moved to the American financial capital to complete her studies at the Metropolitan College of New York where she graduated in General Management. Her training led her to become an Acquisition Analyst with an international real estate company based in New York. Back in France in 2012, she joined the family group. She became Director of Strategy in charge of the development, diversification and digitalization of the Duval Group's activities. She initiated investments in young innovative companies, convinced that this was a solid source of growth. In 2016, she became CEO of the Group.

The supervisory board has 15 members who carry out permanent control of the management of Patrimoine & Commerce. The supervisory board assesses its quality on behalf of the shareholders, to whom it reports each year.

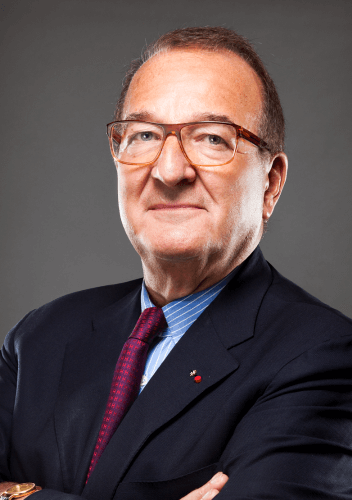

Christian Louis-Victor, representative of Surassur on the audit committee, is a graduated from civil engineering.

He began his career with the Compagnie Générale des Eaux Group where he held various management positions in the housing and home construction sector, including that of Director of the international department of CIP.

In 1985, he joined François Pinault as Chairman-CEO of construction activities.

He acquired these activities and founded Groupe Louis-Victor, approximately 1,000 employees and sales of 150 million euros.

In 1991, he created Compagnie d’Assurances Caution CEGI and chaired it.

In 2000, he merged CEGI with Groupe des Caisses d’Epargne and in 2006 created Compagnie Européenne de Garanties et Cautions CEGC, integrated into the Natixis/BPCE group.

Christian Louis-Victor is Chairman-CEO of GEGC, Vice-chairman of the Board of Directors and Chairman of the Audit Committee of SURASSUR (reinsurer of the Caisse d’Epargne group) and President of the Ecole Supérieure des Professions Immobilières ESPI (real estate professions).

Christian Louis-Victor is also Chairman of the Union des Maison Françaises, founding Chairman of the Union Européenne des Fédérations de Constructeurs de Maisons Individuelles and Chairman of housing trade fairs on the Paris Exhibitions Committee.

Contact

-

-

Christian Louis-Victor, representative of Surassur on the audit committee, is a graduated from civil engineering.

He began his career with the Compagnie Générale des Eaux Group where he held various management positions in the housing and home construction sector, including that of Director of the international department of CIP.

In 1985, he joined François Pinault as Chairman-CEO of construction activities.

He acquired these activities and founded Groupe Louis-Victor, approximately 1,000 employees and sales of 150 million euros.

In 1991, he created Compagnie d’Assurances Caution CEGI and chaired it.

In 2000, he merged CEGI with Groupe des Caisses d’Epargne and in 2006 created Compagnie Européenne de Garanties et Cautions CEGC, integrated into the Natixis/BPCE group.

Christian Louis-Victor is Chairman-CEO of GEGC, Vice-chairman of the Board of Directors and Chairman of the Audit Committee of SURASSUR (reinsurer of the Caisse d’Epargne group) and President of the Ecole Supérieure des Professions Immobilières ESPI (real estate professions).

Christian Louis-Victor is also Chairman of the Union des Maison Françaises, founding Chairman of the Union Européenne des Fédérations de Constructeurs de Maisons Individuelles and Chairman of housing trade fairs on the Paris Exhibitions Committee.

A graduate of ESTP and a Master of Project Management from Northwestern University in Chicago, Camille began her professional life in 2001 at the SCC (Société des Centers Commercials) as project manager on the renovation of the Evry 2 center. She joined the world of investment in 2003 at Colony Capital where she participated in the structuring, management and sale of office development projects in Ile de France. At the end of 2010, she joined Yam Invest, the investment company of the former shareholders of the developer Cogedim, and participated in the creation of the real estate investment platform REALY. Since 2015, Camille has led the asset management of the French office of Westbrook Partners. She implemented the strategy of creating value for the funds' asset portfolio, mainly composed of offices, residential properties and business premises. Camille is a member of the Circle of Women in Real Estate and a professor in the ESTP engineering course.

Contact

-

-

A graduate of ESTP and a Master of Project Management from Northwestern University in Chicago, Camille began her professional life in 2001 at the SCC (Société des Centers Commercials) as project manager on the renovation of the Evry 2 center. She joined the world of investment in 2003 at Colony Capital where she participated in the structuring, management and sale of office development projects in Ile de France. At the end of 2010, she joined Yam Invest, the investment company of the former shareholders of the developer Cogedim, and participated in the creation of the real estate investment platform REALY. Since 2015, Camille has led the asset management of the French office of Westbrook Partners. She implemented the strategy of creating value for the funds' asset portfolio, mainly composed of offices, residential properties and business premises. Camille is a member of the Circle of Women in Real Estate and a professor in the ESTP engineering course.

Axel Bernia, representative of Naxicap Partners on the supervisory board, is graduated from HEC.

Axel Bernia began his career in strategy consulting at McKinsey & Co before joining SNCF in 2004 to work on launching from iDTGV.

Then, he joined the Smartbox Group and became Chief Executive Officer from 2006 to 2013.

He joined Naxicap Partners in 2014, as Associate Director and Member of the Management Board.

He currently works with Clinique Internationale du Parc Monceau, Ecotel Chomette Favorite, Adcash, Trustteam, Maxi Bazar and France Hospitality.

Contact

-

-

Axel Bernia, representative of Naxicap Partners on the supervisory board, is graduated from HEC.

Axel Bernia began his career in strategy consulting at McKinsey & Co before joining SNCF in 2004 to work on launching from iDTGV.

Then, he joined the Smartbox Group and became Chief Executive Officer from 2006 to 2013.

He joined Naxicap Partners in 2014, as Associate Director and Member of the Management Board.

He currently works with Clinique Internationale du Parc Monceau, Ecotel Chomette Favorite, Adcash, Trustteam, Maxi Bazar and France Hospitality.

Emmanuel Chabas, representative of Crédit Agricole Assurances on the supervisory board, is graduatec from ESSEC. Emmanuel Chabas began his career in management control and internal audit within the BNP Paribas group in 2001.

Then, he joined BNP Paribas Cardif in 2006 as Head of real estate acquisitions.

Since 2015, he has held the position Head of Real Estate Investments at Crédit Agricole Assurances.

Contact

-

-

Emmanuel Chabas, representative of Crédit Agricole Assurances on the supervisory board, is graduatec from ESSEC. Emmanuel Chabas began his career in management control and internal audit within the BNP Paribas group in 2001.

Then, he joined BNP Paribas Cardif in 2006 as Head of real estate acquisitions.

Since 2015, he has held the position Head of Real Estate Investments at Crédit Agricole Assurances.

Audrey Chatain, 35, has been a chartered accountant since 2018. She is general director of SAS GCR – an accounting company. She represents the company BMR Holding on the supervisory board of P&C.

Contact

-

-

Audrey Chatain, 35, has been a chartered accountant since 2018. She is general director of SAS GCR – an accounting company. She represents the company BMR Holding on the supervisory board of P&C.

Louis-Victor Duval, 31, is Deputy Managing Director of the Duval Group. He holds a Master's degree from the Ecole Supérieure des Professions Immobilières (ESPI). He previously spent 4 years with Linkcity, setting up real estate operations, before becoming Groupe Duval's Strategy and Development Director.

Contact

-

-

Louis-Victor Duval, 31, is Deputy Managing Director of the Duval Group. He holds a Master's degree from the Ecole Supérieure des Professions Immobilières (ESPI). He previously spent 4 years with Linkcity, setting up real estate operations, before becoming Groupe Duval's Strategy and Development Director.

Margaux Graff, representative of Daytona Holdings on the supervisory board, has a Masters in International Business from Hult International Business School London and a Masters in Hospitality Management at Glion Institute of Higher Education.

Since 2012, she is Property Asset Manager at Daytona in Luxembourg.

Contact

-

-

Margaux Graff, representative of Daytona Holdings on the supervisory board, has a Masters in International Business from Hult International Business School London and a Masters in Hospitality Management at Glion Institute of Higher Education.

Since 2012, she is Property Asset Manager at Daytona in Luxembourg.

Hugues Grimaldi, 56, with a legal background, began his career with CREDIT AGRICOLE ASSURANCES / PREDICA in 2005.

He is chairman of several OPCIs and administrator in various real estate structures (representative of Prédica, Member of the Supervisory Board).

Contact

-

-

Hugues Grimaldi, 56, with a legal background, began his career with CREDIT AGRICOLE ASSURANCES / PREDICA in 2005.

He is chairman of several OPCIs and administrator in various real estate structures (representative of Prédica, Member of the Supervisory Board).

Thomas Guyot, 47, representing Suravenir on the Supervisory Board, is a graduate of the Ecole Polytechnique. He began his career in the telecommunications sector, at Cegetel Entreprises before joining Crédit Mutuel Arkéa in 2006, as Marketing Director of Symphonis, which later merged with Fortuneo. He then took charge of balance sheet management at Crédit Mutuel Arkéa, before taking over management of the trading room in 2008. He joined Suravenir in 2012 as technical and financial director and member of the management board. In this capacity, he notably supervises the financial management of the company and its investments, as well as the implementation of Solvency 2 and then IFRS 17. He has been Chairman of the Management Board of Suravenir since February 1, 2022.

Contact

-

-

Thomas Guyot, 47, representing Suravenir on the Supervisory Board, is a graduate of the Ecole Polytechnique. He began his career in the telecommunications sector, at Cegetel Entreprises before joining Crédit Mutuel Arkéa in 2006, as Marketing Director of Symphonis, which later merged with Fortuneo. He then took charge of balance sheet management at Crédit Mutuel Arkéa, before taking over management of the trading room in 2008. He joined Suravenir in 2012 as technical and financial director and member of the management board. In this capacity, he notably supervises the financial management of the company and its investments, as well as the implementation of Solvency 2 and then IFRS 17. He has been Chairman of the Management Board of Suravenir since February 1, 2022.

Lydia Le Clair, representative of the Duval Group on the audit committee, is a certified public accountant.

She began her career in accounting firms, before joining the Duval Group in 1998.

She is now Managing Director.

Contact

-

-

Lydia Le Clair, representative of the Duval Group on the audit committee, is a certified public accountant.

She began her career in accounting firms, before joining the Duval Group in 1998.

She is now Managing Director.

Marie Monnet, representative on the supervisory board, is graduated from EDHEC Business School and an MBA from Loyola Marymount University in Los Angeles.

After a postgraduate degree in finance at the University of Paris II, Marie Monnet was, at Morgan Stanley for 5 years, Vice-president of European and American equities sales to French institutional investors.

Then, at Merill Lynch, Vice-president of European equities sales for French clients for 3 years.

Since 2011, she has owned and managed a hotel in Paris.

Contact

-

-

Marie Monnet, representative on the supervisory board, is graduated from EDHEC Business School and an MBA from Loyola Marymount University in Los Angeles.

After a postgraduate degree in finance at the University of Paris II, Marie Monnet was, at Morgan Stanley for 5 years, Vice-president of European and American equities sales to French institutional investors.

Then, at Merill Lynch, Vice-president of European equities sales for French clients for 3 years.

Since 2011, she has owned and managed a hotel in Paris.

Mathieu Requillart, 53, has been Managing Director of Banque Populaire Val de France since January 1, 2022. After having held commercial and risk functions within the BNP group and CIC, Mathieu Réquillart joined Banque Populaire du Nord in 2006. He was appointed member of the management committee in 2009 to serve as director of credits and then director of operations. In 2017, he joined the management board of Caisse d'Epargne Bretagne Pays de Loire, successively as Regional Development Bank agent and Retail Banking agent.

Contact

-

-

Mathieu Requillart, 53, has been Managing Director of Banque Populaire Val de France since January 1, 2022. After having held commercial and risk functions within the BNP group and CIC, Mathieu Réquillart joined Banque Populaire du Nord in 2006. He was appointed member of the management committee in 2009 to serve as director of credits and then director of operations. In 2017, he joined the management board of Caisse d'Epargne Bretagne Pays de Loire, successively as Regional Development Bank agent and Retail Banking agent.

Aurélie Tristant, representative of Banque Palatine on the supervisory board, is graduated from the Rouen Business School.

Aurélie Tristant is a member of the Executive Committee of Banque Palatine, which she joined in 1988 as as a Credit Analyst in the Commitments Department.

Four years later, she was seconded to Sanpaolo IMI in New York.

In 1993, she was appointed Head of Special Affairs.

Two years later, she was promoted to Director of mixed branches (private and business customers) in Paris and the Paris region, then Director of the central branch, and Director of the Paris West and North of France region.

In 2009, she is appointed Marketing Director of Banque Palatine.

Since 2014, Aurélie Tristant has served as Market Director for companies at Banque Palatine.

Aurélie Tristant is also co-founder of the "Palatine au Féminin".

Contact

-

-

Aurélie Tristant, representative of Banque Palatine on the supervisory board, is graduated from the Rouen Business School.

Aurélie Tristant is a member of the Executive Committee of Banque Palatine, which she joined in 1988 as as a Credit Analyst in the Commitments Department.

Four years later, she was seconded to Sanpaolo IMI in New York.

In 1993, she was appointed Head of Special Affairs.

Two years later, she was promoted to Director of mixed branches (private and business customers) in Paris and the Paris region, then Director of the central branch, and Director of the Paris West and North of France region.

In 2009, she is appointed Marketing Director of Banque Palatine.

Since 2014, Aurélie Tristant has served as Market Director for companies at Banque Palatine.

Aurélie Tristant is also co-founder of the "Palatine au Féminin".

The investment committee is chaired by Eric Ranjard and made up of 4 members. The investment committee issues opinions on investment or disinvestment projects proposed by the management. A majority of the members take the decisions. The decisions are communicated to the supervisory board which decides on the decisions. The external members designated as members of the investment committee are appointed due to their professional experience which will bring real and recognised expertise to the investment committee.

The audit commitee is mainly composed of supervisory board's members. Those members are experts in finance and management. The audit committee provides assistance and issues opinions to the supervisory board for financial and accounting matters. It also ensures respect of the procedures for in-house advice and the monitoring of risks with respect to Patrimoine & Commerce.

The remuneration committee is composed of 3 members. It issues opinions or recommendations to the supervisory board regarding the remuneration of the managers and members of the supervisory board.

The CSR committee is made up of 5 members. The CSR committee is chaired by Marie Monnet and is made up of five people from the Supervisory Board. The members of the CSR Committee are: